1.1 Accounting: The Language of Business

Understanding the Role of Accounting

Accounting is an information system that measures and records business activities. The role of accounting is to identify, record, and measure the transactions or activities in a business to be able to evaluate its performance and assess its financial health

- (Harrison et al., 2018, p. 3)

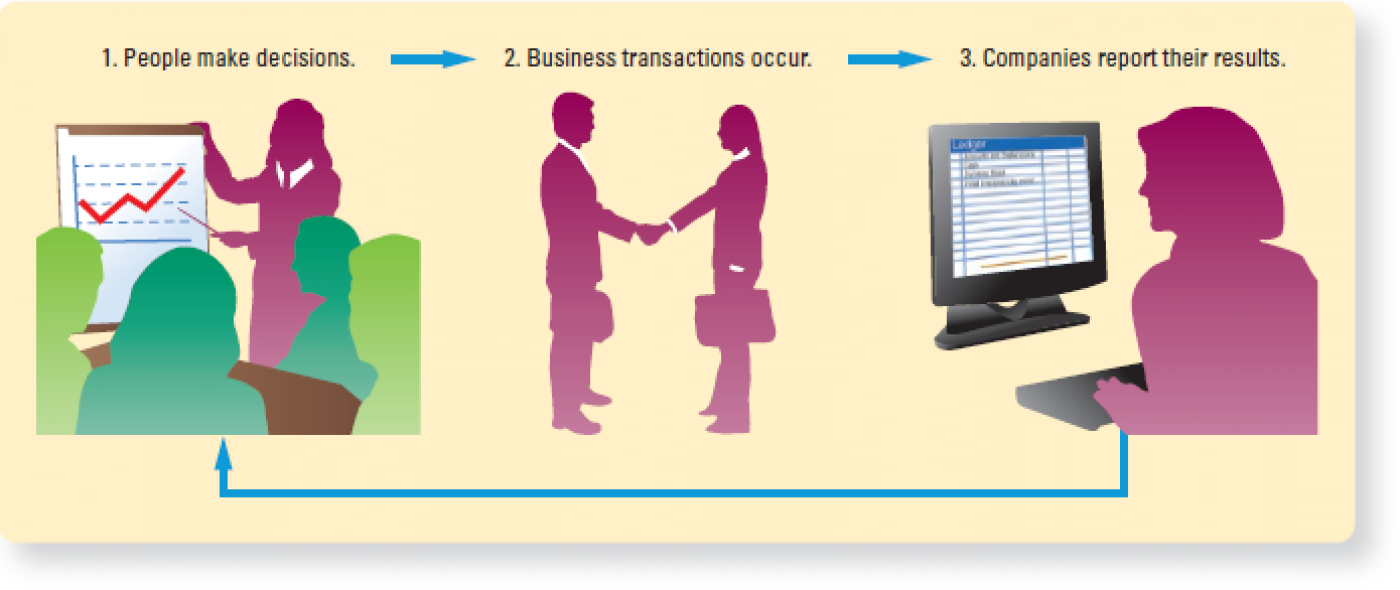

This information is communicated to stakeholders using financial statements that contain useful information to help them make rational economic decisions. Financial statements are prepared based on a set of accounting rules, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS); these help standardize accounting across businesses. Review the flow of accounting information diagram below.

This diagram illustrates the flow of accounting information and helps illustrate accounting’s role in business. The accounting process begins and ends with people making decisions.

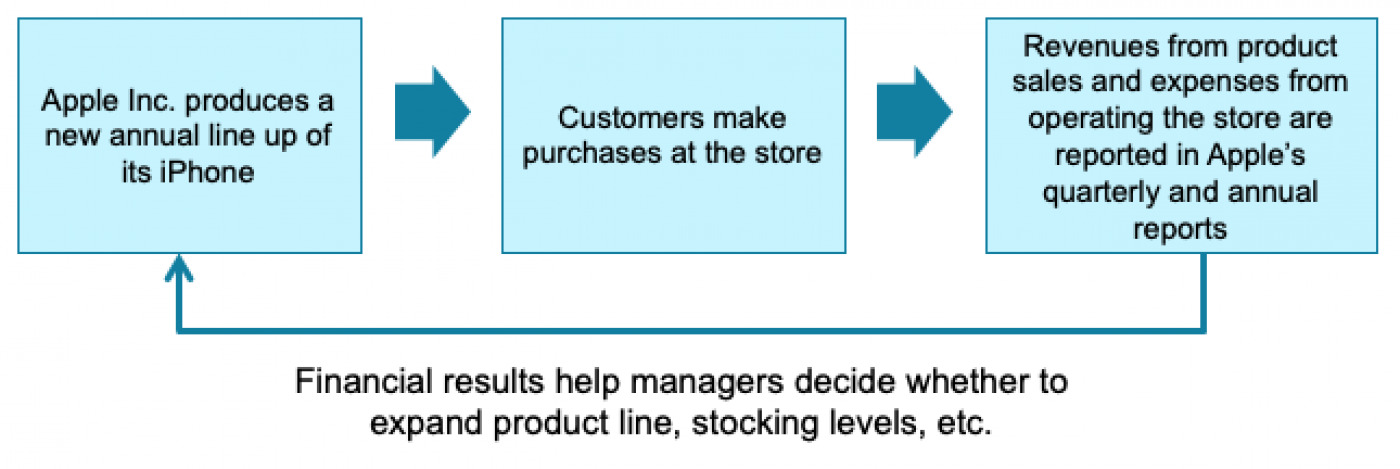

Let’s apply the flow of accounting information to a real business: Apple Inc.

In this diagram, it begins with production. Apple Inc. produces a new annual line up of its iPhone. Then, it moves to purchasing. Customers make purchases at the store. From there is reporting. Revenues from the product and expenses from operating the store are reported in Apple’s quarterly and annual reports. These financial results inform managers’ decisions regarding product line, stocking, etc. This brings us back to production.

The Four Financial Statements

The flow of accounting results in transactions that are recorded and presented using four important financial statements to report the results to various stakeholders. We will explore these four financial statements further in the next topic.

Note: The order is important! The first is income statements, then statement of retained earnings, balance sheet, and lastly statement of cash flow.

Users of Financial Information

These financial statements are used by different stakeholders. So, who are the users of financial information?

Managers: set goals, evaluate those goals, and take corrective action.

-

Most companies hire managers to oversee the day-to-day operations of the business (i.e., operating activities).

-

Managers make many business decisions using accounting info:

- Should they build a new product line?

- Should they open a regional sales office?

- Should they acquire a competitor?

- Should they extend credit to their major customers?

Investors: decide whether to invest in a business or evaluate an investment.

-

Investors are individuals/groups who provide capital to finance a business’s activities by purchasing ownership interest. They own shares of the business and are called shareholders.

-

Investors look for two sources of possible gain:

- Sell ownership interest in the future for more than they paid.

- Receive a portion of the company’s earnings in cash (dividends).

-

Investors (shareholders) use accounting information to find out how much income they can expect to earn on their investment and where to invest their money.

- You too are an investor if you buy stocks, debt, or real estate! Financial information can help you decide where to invest your money.

Creditors: evaluate a borrower’s ability to make required payments.

-

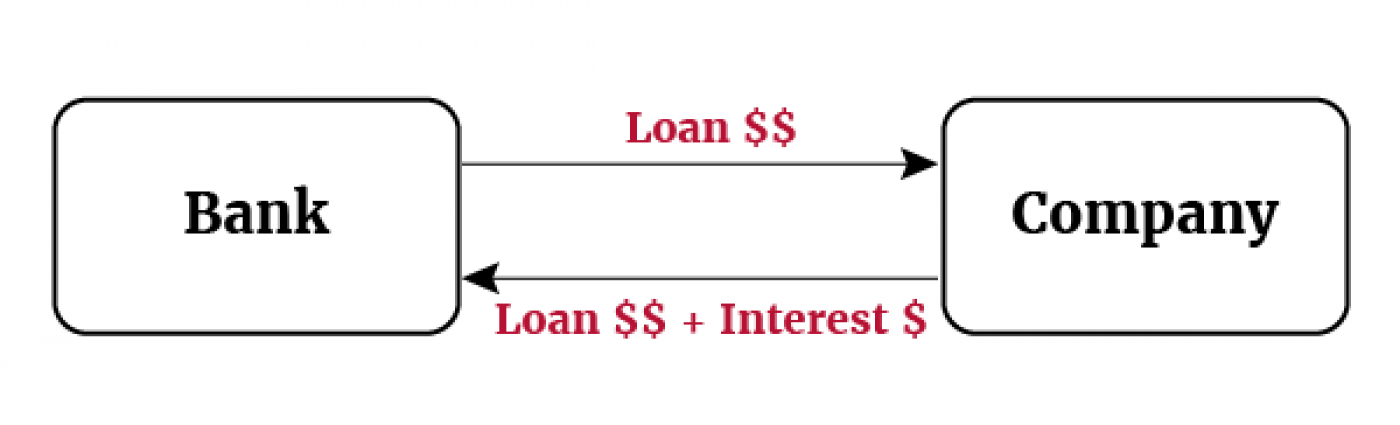

Creditors provide capital to finance a business’s activities by lending money. Unlike investors, creditors do not own a share of the company.

-

For example, a bank lends funds to a company in the form of a loan that must be repaid by the company in the future along with interest.

Government and regulatory bodies such as Canada Revenue Agency (CRA): ensure organizations pay the correct amount of taxes.

-

Government and regulatory bodies use accounting information for taxation and regulation of the stock markets.

-

For example, the CRA uses financial information to compute the sales and business taxes owed by a business and the Ontario Securities Commission requires periodic financial information from companies that are stock listed on the Toronto Stock Exchange (TSX).

Individuals: make investment decisions and/or manage a bank account.

-

Individuals like you and me use financial information to make daily purchasing decisions.

-

Do you budget your annual, monthly, or weekly spending? Even high-level budgeting of your tuition, rent, food, and transportation is, in a way, using financial information to determine your financial needs.

Not-for-profit organizations: use accounting information in virtually the same way as for-profit organizations.

-

Like for-profit companies, not-for-profit organizations use financial information to make decisions about their operations and investments, and to report financial information to their users.

-

Users of financial information for a not-for-profit organization include board members, managers, and the CRA.

-

The CRA has a designated non-taxable business status for approved not-for-profit organizations. These designated organizations need to comply with reporting requirements and do not have to pay regular business taxes like for-profit companies.

Financial vs. Management Accounting

Since different users have different reporting needs and underlying reasons for financial information, there are two types of accounting information:

Financial Accounting

Financial accounting provides information for different internal and external users:

- Internal users

-

Managers

-

Investors

-

- External users

-

Creditors

-

Government

-

Public

-

Financial accounting is the focus of our course!

Management Accounting

Management accounting provides the following information for internal users only:

-

Budgets

-

Forecasts

-

Projections

-

Detailed product level/department level information

This is most likely your next accounting course!

Types of Business Organizations

There are three main forms of business organizations: proprietorship, partnership, and corporation.

| Proprietorship | Partnership | Corporation | |

|---|---|---|---|

| Owner(s) | Single owner known as the proprietor | Generally two or more partners are co-owners |

Owned by shareholders and legally formed under federal or provincial law:

|

| Personal liability of owner(s) for business debts | Proprietor is personally liable | Partners are usually personally liable | Shareholders are not personally liable |

| Life of entity | Limited by owner’s choice or death | Limited by owner’s choice or death | Indefinite (owned by shareholders) |

| Tax structure | Included in personal taxes of the proprietor | Doesn’t pay taxes as income flows through to individual partners and is taxed at their personal tax rate | Corporation pays taxes and any dividends paid to shareholders are taxed at their personal tax rate |

| Examples |

Common business structure for self-employed, small retail stores, or professional service providers:

|

The Big Four accounting companies are all partnerships:

|

Public companies:

Private companies:

|