1.2 Exploring Financial Statements

- Read more about 1.2 Exploring Financial Statements

- Log in or register to post comments

- 28 views

The Generally Accepted Accounting Principles (GAAP)

The four main financial statements were briefly introduced in the first topic. The basis on which these financial statements are prepared is known as the Generally Accepted Accounting Principles (GAAP). These standards, which specify that financial information must be recorded, measured, and reported, are universally used by accountants to prepare financial statements consistently.

There are multiple sets of GAAP and each is applicable based on the type of entity or organization.

In Canada, GAAP are established by the Chartered Professional Accountants (CPA) of Canada.

- Canadian public enterprises (stock-listed corporations) must use International Financial Reporting Standards (IFRS).

- IFRS are set by the International Accounting Standards Board (IASB).

- For example: Canadian Tire is listed on the TSX (CTC.A) and must use IFRS to report its financial statements.

However, Canadian private enterprises (not issued stock or debt on public markets) can use either IFRS or Accounting Standards for Private Enterprises (ASPE). Most private companies use ASPE to prepare their financial statements. This is because IFRS is costly and complex, especially for larger companies with complex operations.

Other sets of GAAP are applicable to not-for-profit organizations, pension plans, and government entities. You will learn about these GAAP in advanced accounting courses.

(Adapted from Harrison et al., 2018, p. 7–8)

The Four Financial Statements

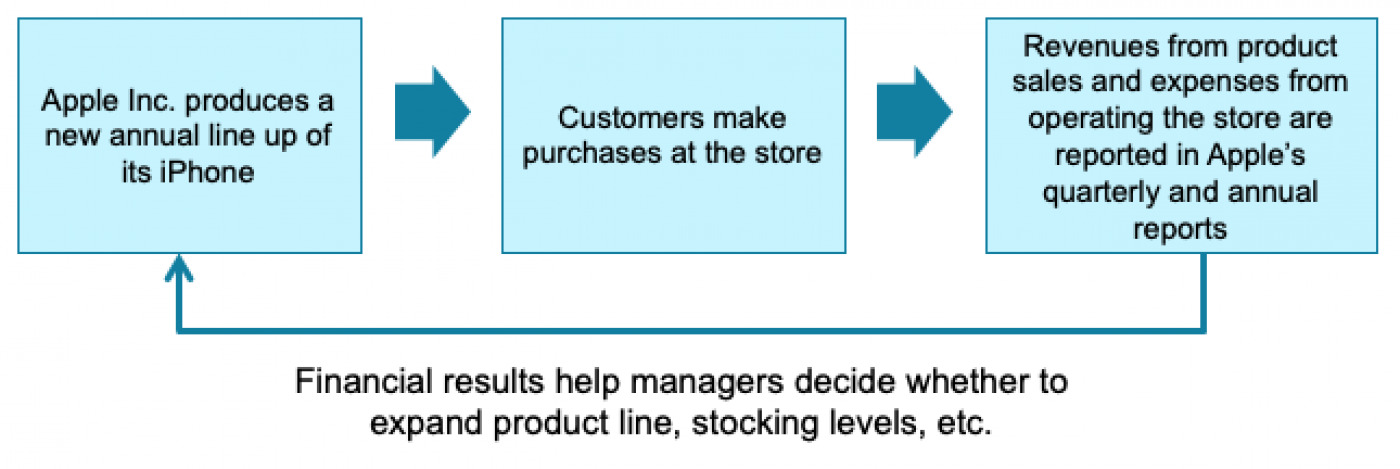

The financial statements prepared using these standards help stakeholders assess the performance of the business for a given period. This table provides a great overview of the purpose served and questions answered by each of these financial statements:

| Question | Financial Statement | Elements |

|---|---|---|

| 1. How well did the company perform during the year? | Income statement | Revenues + gains – (Expenses + losses) = Net income or (net loss) |

| 2. Why did the company's retained earnings change during the year? | Statement of retained earnings | Beginning retained earnings + Net Income + Other comprehensive income – Dividends = Ending retained earnings |

| 3. What is the company's financial position at year-end? | Balance sheet | Assets = Liabilities + Owners' equity |

| 4. How much cash did the company generate and spend during the year? | Statement of cash flows | Operating cash flows +/– Investing cash flows +/– Financing cash flows = Increase (decrease) in cash |

(Harrison et al., 2018, p. 7)

Let’s take a look at each of these financial statements in greater detail.

Login or register to share your adaptations.

List of adaptions

Be the first to add your adaptation here!

Login or register to engage in the review and feedback process.

Reviews and Feedback

Be the first to review!

Comments

Be the first to comment!