Top Bar Region - Tutorials

Brief Description

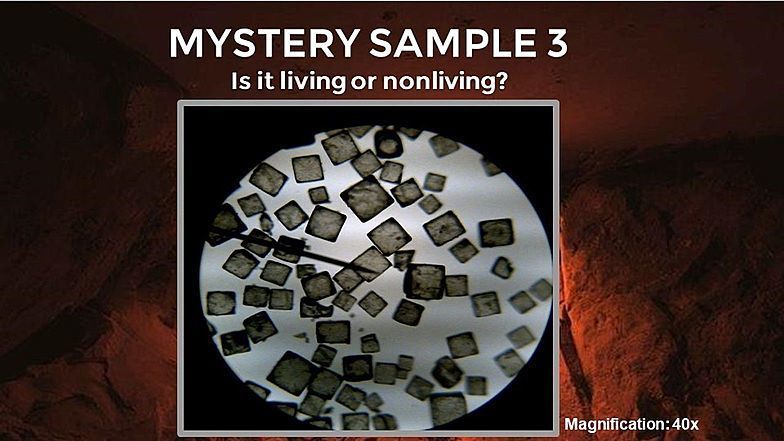

cells are extraordinary and are our body's main important members well for a practical joke I wouldn't think or brain, heart, kidneys, and intestines would say the same thing (HaHAHa) anyway back to the point cells are what get our blood flowing, our hearts pumping, our kidneys working, our muscles moving our vessels producing, our brain and brain cells thinking and leading our cells are so important to our body hope you enjoyed thisThe human body is a complex and remarkable organism, and at the core of its functioning are the cells. These tiny, yet extraordinary entities work tirelessly to keep our bodies healthy and functional. From circulating blood and oxygen throughout our bodies to powering our muscles and organs - cells are the unsung heroes of our physiological systems.

It's awe-inspiring to think that the trillions of cells in our bodies work in harmony to keep us alive and well. Each cell is unique and specialized, with a specific role to play in maintaining our health and wellbeing. From the neurons in our brains that allow us to think and feel, to the muscle cells that allow us to move and exercise - every cell is crucial to our overall health.

As we continue to learn more about the incredible power of cells, we are constantly reminded of their importance and potential. The future of medicine and healthcare lies in our ability to harness the power of cells to heal and regenerate damaged tissues and organs. With advancements in stem cell research and regenerative medicine, we are on the cusp of a new era in healthcare - one that is centered around the incredible potential of cells.

So let us take a moment to appreciate these remarkable entities that make up our bodies and keep us healthy and alive. Let us marvel at their complexity and celebrate their importance. The cells in our bodies may be small, but their impact on our health and well-being is truly immeasurable. Half work done by Grammarly woohoo for Grammarly you can try it, it is amazing

Top Bar Region - Lesson - Clone

This work is a derivative

Off

Comments

Be the first to comment!